Forex trading, also known as foreign trade trading, requires the getting and offering of currencies on the international change market with desire to of creating a profit. It’s the biggest financial market internationally, having an average day-to-day trading volume exceeding $6 trillion. Forex trading presents investors and traders the chance to imagine on the fluctuation of currency rates, allowing them to probably make money from changes in trade rates between different currencies.

One of many critical top features of forex trading is their decentralized nature, as it operates 24 hours a day, five times a week across various time locations worldwide. This convenience allows traders to participate available in the market at any time, providing ample possibilities for trading round the clock. Furthermore, the forex industry is extremely liquid, and thus currencies can be purchased and bought easily and easily without significantly affecting their prices.

Forex trading requires the usage of power, allowing traders to manage larger roles with a lot less of capital. While control may improve gains, in addition, it increases the chance of failures, as even small changes in currency rates can result in significant gains or losses. Thus, it’s essential for traders to manage their risk cautiously and use suitable chance administration strategies, such as for instance setting stop-loss orders and diversifying their trading portfolio.

More over, forex trading offers a wide selection of trading strategies and techniques, including technical examination, elementary analysis, and sentiment analysis. Specialized examination requires studying historical cost data and applying various signals and chart styles to spot tendencies and predict future value movements. Simple examination, on one other give, centers on studying economic signals, media activities, and geopolitical developments to measure the intrinsic price of currencies. Feeling evaluation requires assessing market belief and investor behavior to assume shifts in industry sentiment.

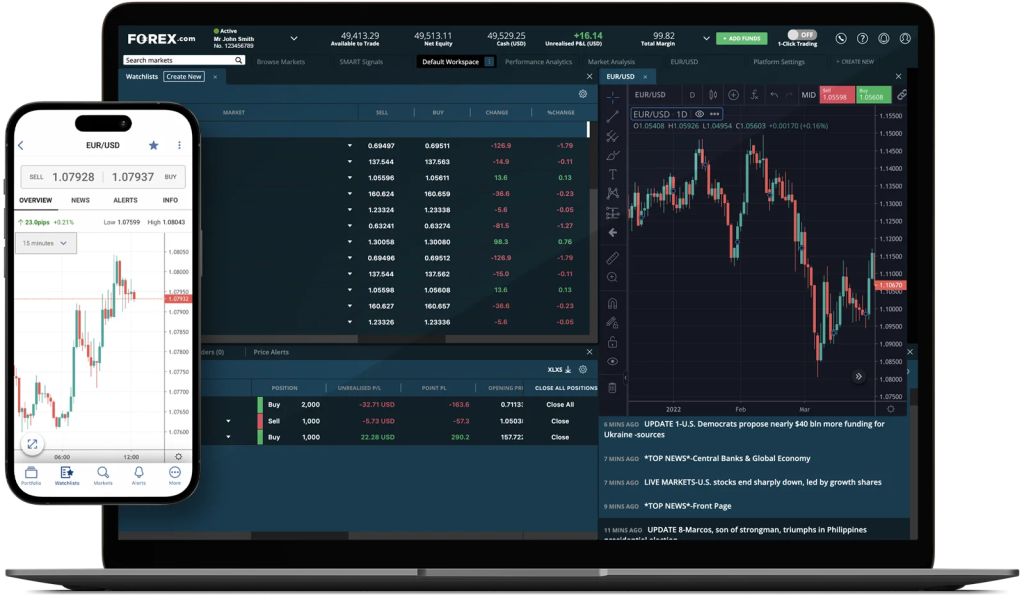

Furthermore, breakthroughs in technology have transformed the landscape of forex trading, making it more available and successful than ever before. On the web trading systems and cellular apps let traders to accomplish trades, access real-time market data, and check their roles from everywhere with a net connection. Furthermore, computerized trading methods, such as expert advisors (EAs) and trading robots, can execute trades quickly predicated on pre-defined criteria, removing the need for information intervention.

Despite their potential for revenue, forex trading bears natural risks, and traders should be aware of the issues and issues connected with the market. Volatility, geopolitical activities, and sudden market movements can cause considerable losses, and traders should forex robot be prepared to handle these dangers accordingly. Furthermore, cons and fraudulent activities are common in the forex industry, and traders should exercise caution when choosing a broker or investment firm.

To conclude, forex trading supplies a energetic and potentially lucrative chance for investors and traders to participate in the global currency markets. With its decentralized nature, large liquidity, and accessibility, forex trading is becoming significantly common among people seeking to diversify their expense account and capitalize on currency value movements. However, it is needed for traders to educate themselves about the market, produce a stable trading strategy, and training disciplined risk administration to flourish in forex trading on the extended term.