Forex trading, also known as foreign exchange trading or currency trading, could be the international market place for getting and offering currencies. It works 24 hours each day, five times a week, enabling traders to participate on the market from everywhere in the world. The primary goal of forex trading is always to benefit from fluctuations in currency trade prices by speculating on whether a currency set can rise or drop in value. Participants in the forex industry contain banks, economic institutions, corporations, governments, and specific traders.

Among the essential features of forex trading is its high liquidity, meaning that large quantities of currency are available and offered without somewhat affecting change rates. This liquidity ensures that traders may enter and exit jobs quickly, permitting them to make the most of also little cost movements. Furthermore, the forex industry is extremely available, with minimal barriers to entry, allowing people to begin trading with somewhat small levels of capital.

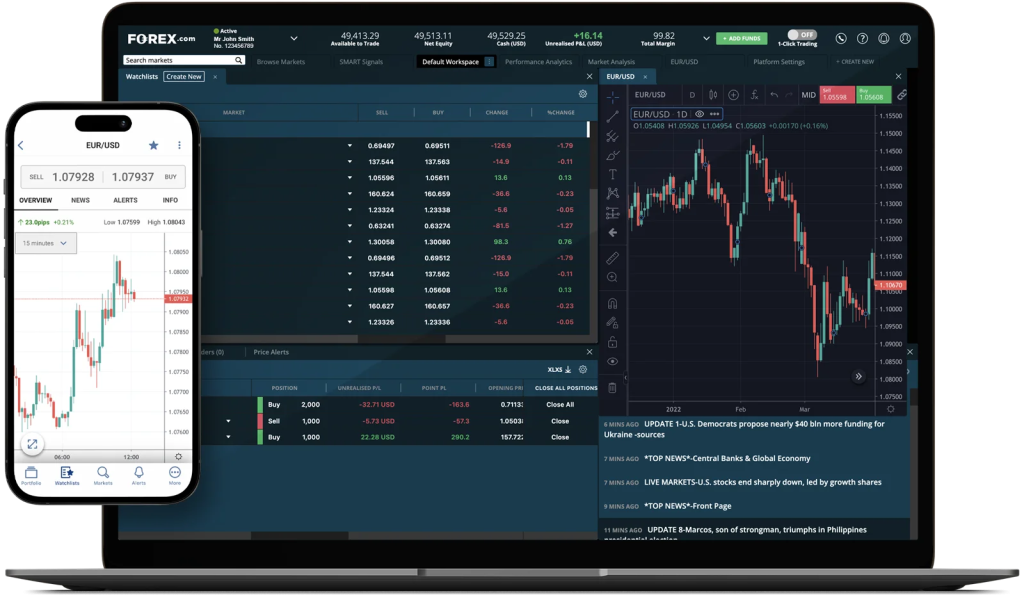

Forex trading offers a wide range of currency sets to deal, including major couples such as for instance EUR/USD, GBP/USD, and USD/JPY, in addition to minor and unique pairs. Each currency set presents the trade charge between two currencies, with the first currency in the set being the beds base currency and the second currency being the offer currency. Traders may profit from both increasing and slipping markets by using extended (buy) or small (sell) jobs on currency pairs.

Effective forex trading takes a solid comprehension of fundamental and complex analysis. Simple examination involves evaluating financial indicators, such as for instance fascination prices, inflation rates, and GDP growth, to gauge the underlying strength of a country’s economy and its currency. Complex examination, on another hand, requires examining price graphs and habits to identify tendencies and possible trading opportunities.

Chance administration can also be necessary in forex trading to guard against potential losses. Traders often use stop-loss purchases to restrict their downside risk and employ proper position size to ensure that no business may considerably impact their overall trading capital. Furthermore, sustaining a disciplined trading method and handling emotions such as for instance greed and concern are important for long-term success in forex trading.

With the development of engineering, forex trading has be available than actually before. On the web trading tools and portable programs offer traders with real-time use of the forex market, allowing them to accomplish trades, analyze market information, and manage their portfolios from any device. Moreover, the option of academic forex robot assets, including guides, webinars, and trial records, empowers traders to develop their abilities and boost their trading efficiency over time.

While forex trading offers significant income potential, additionally it provides natural risks, like the possibility of significant losses. Thus, it’s required for traders to perform thorough research, develop a sound trading strategy, and constantly check industry situations to make informed trading decisions. By sticking with disciplined chance administration methods and staying knowledgeable about international economic developments, traders may improve their chances of accomplishment in the powerful and ever-evolving forex market.